utah county food sales tax

Counties may adopt this tax to support tourism recreation cultural convention or airport facilities within their jurisdiction. The state sales tax rate in Utah is 4850.

The 2018 United States Supreme Court decision in South Dakota v.

. In Salt Lake County for example the combined sales tax rate as of January 1 2022 is 725. The Utah County sales tax rate is. It is assessed in addition to sales and use taxes on sales of food prepared for immediate consumption by.

Grocery food does not include alcoholic beverages or tobacco. This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. There are a total of 131 local tax jurisdictions across the.

Used by the county that imposed the tax. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Uintah County Sales Tax.

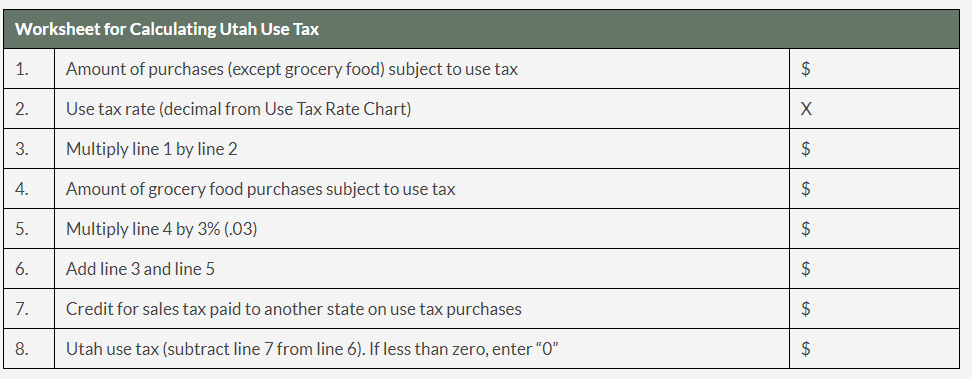

If a locality within a county is not listed with a separate rate use the county rate. You collect tax at the grocery food rate 3 percent on the grocery food and the combined sales tax rate at your location for the clothing. Tax rates tend to be slightly higher in urban areas.

274 rows 2022 List of Utah Local Sales Tax Rates. The tax on grocery food is 3 percent. Back to Utah Sales Tax Handbook Top.

Report and pay sales tax electronically on Taxpayer Access Point TAP at taputahgov using the template for form TC-62M Sales and Use Tax Return. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. Wayne County Sales Tax.

With local taxes the total sales tax rate. In the state of Utah the foods are subject to local taxes. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition.

Restaurants must also collect a 1. 6 rows The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax. 2022 Utah state sales tax.

All Utah citiestowns listed alphabetically by county. The Utah County Tax Administration office does not provide any advice legal or otherwise to any prospective buyer beyond answering questions related to the procedures of administering the sale. The event will take place at a Hy-Vee in the Kansas City.

Has impacted many state nexus laws and sales tax collection requirements. Utah County Sales Tax. 59-2-13511 Tax sale -- Combining certain parcels -- Acceptable bids -- Deeds.

9 hours agoTOPEKA KSNT Kansas Governor Laura Kelly is in the Kansas City area Wednesday to sign a bill phasing out the states food sales tax. Both food and food ingredients will be taxed at a reduced rate of 175. Wasatch County Sales Tax.

The new law drops the tax to 4 in January to 2 in 2024 and to zero in 2025. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. 91 rows This page lists the various sales use tax rates effective throughout Utah.

Lowest sales tax 61 Highest sales tax. You may use the. Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2108 on top of the state tax.

A county-wide sales tax rate of 08 is applicable to localities in Utah County in addition to the 485 Utah sales tax. 100 East Center Street Suite 1200 Provo Utah 84606 Phone. Click on any county for detailed sales tax rates or see a full list of Utah counties here.

Weber County Sales Tax. The Utah County Sales Tax is 08. Some cities and local governments in Utah County collect additional local sales taxes which can be as high as 16.

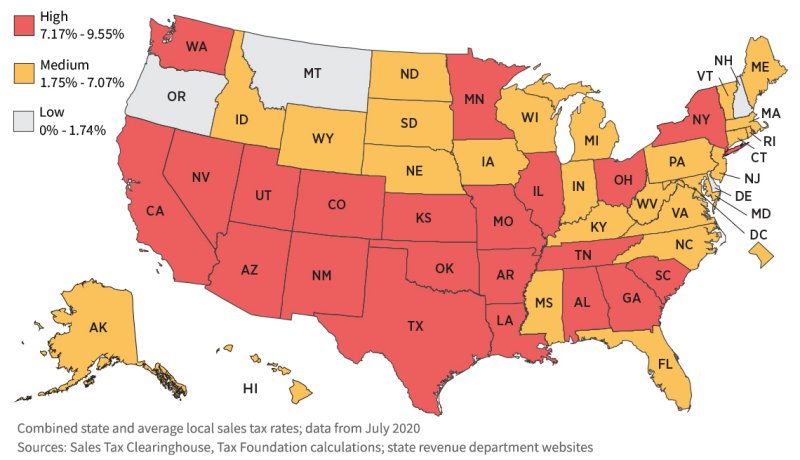

6 hours agoOnly 13 states charge any sales tax on groceries. Sales by county -- Notice of tax sale -- Entries on record. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 42.

The following documents give cross-listings of Utahs cities towns counties and entity codes for sales and use tax purposes. Exact tax amount may vary for different items. Washington County Sales Tax.

Streamlined Sales Tax SST Training Instruction. Monday - Friday 800 am - 500 pm. Combined rates in some of Utahs more popular car buying locations are as follows.

Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice. Kansas rate is second only to Mississippis 7. Alphabetical listing of all Utah citiestowns with corresponding county.

These transactions are also subject to local option and county option sales tax and that results in a total combined rate on grocery food of 3 throughout the state of Utah. See taxutahgovsalesrates for current. The Utah state sales tax rate is currently.

See Pub 25 Sales and Use Tax for more information. By comparison Piute County collects a total of 61 of the purchase price. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175.

Is Food Taxable In Utah Taxjar

Utah Sales Tax Rates By City County 2022

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

Sales Tax On Grocery Items Taxjar

How To Get A Sales Tax Exemption Certificate In Utah

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Ventura S Measure O Is A Regressive Tax Measurements Tax Estate Tax

States With Highest And Lowest Sales Tax Rates

Up To 50 Off Gourmet Pizza Gourmet Pizza Pizza Gourmet

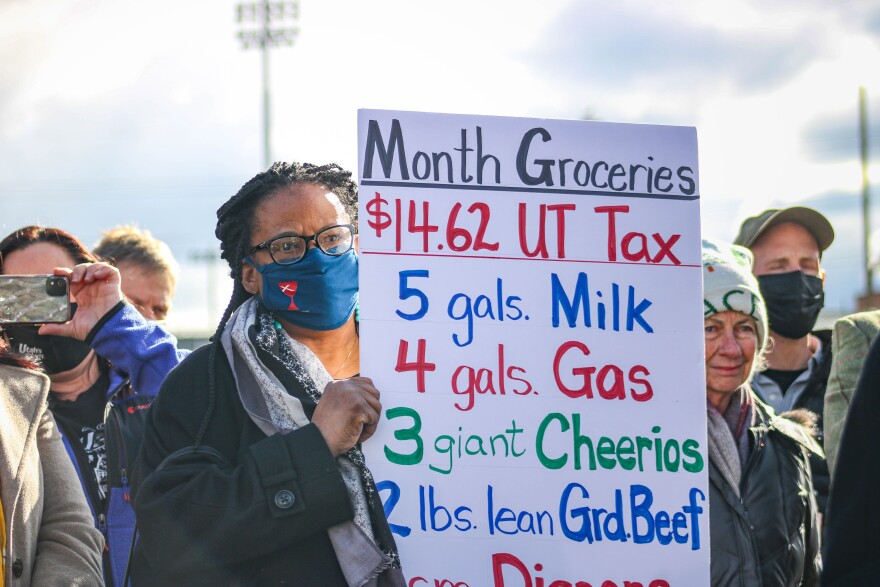

Sales Tax Cut On Food Seen As Long Shot In Utah Legislature Cache Valley Daily

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer